How Much Is Fica Tax 2025

How Much Is Fica Tax 2025 - How Much Is Fica Tax 2025. The social security tax rate is unchanged for. 10 announced a higher threshold for earnings. Fica Tax Amount 2025 Penelope Parsons, They generally add up to 7.65% of your wages or salary and are mandatory.

How Much Is Fica Tax 2025. The social security tax rate is unchanged for. 10 announced a higher threshold for earnings.

2025 Fica Tax Rates And Limits Andre Amills, That’d be a $6,300 increase from the.

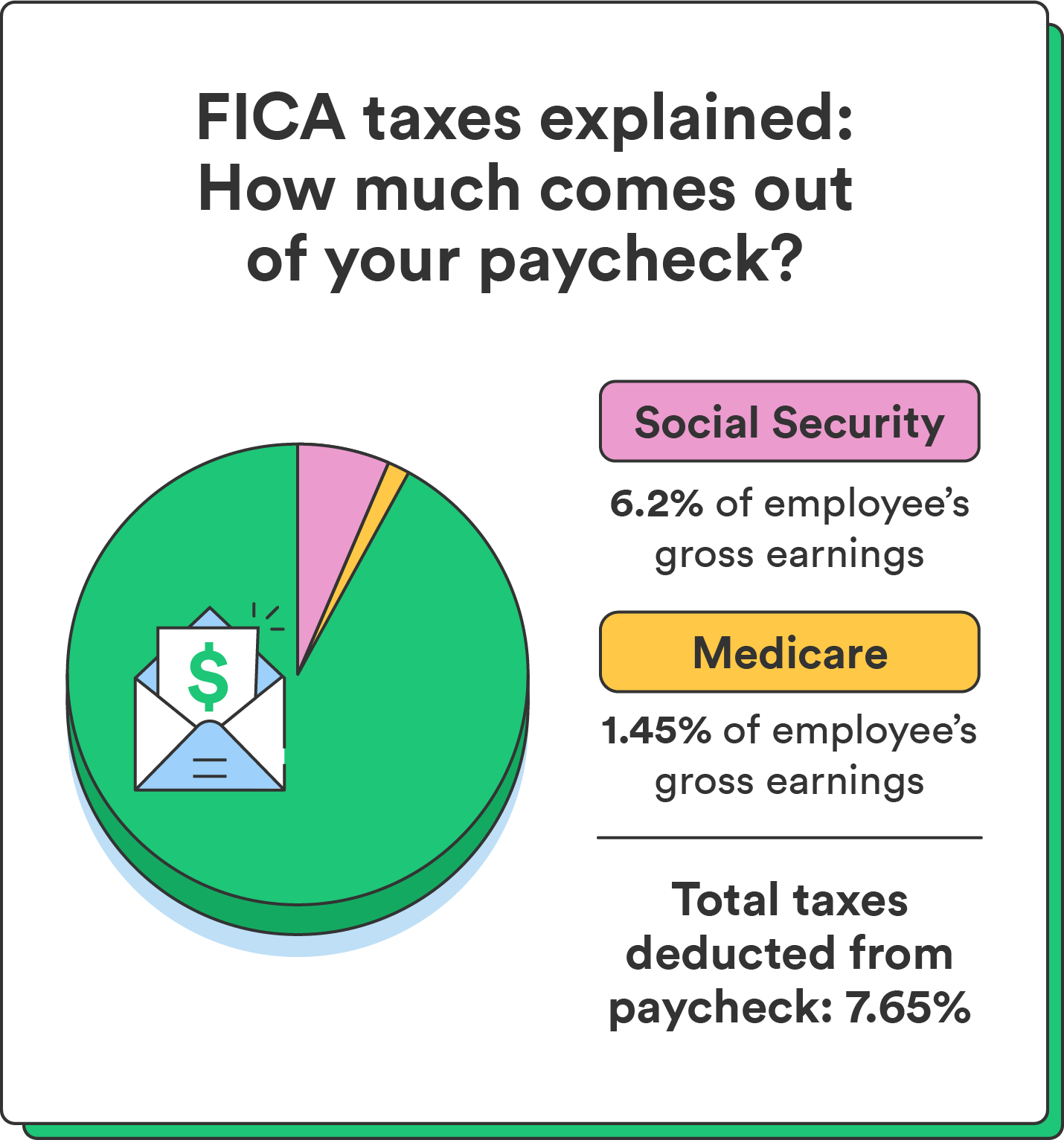

2025 Fica Tax Rates And Limits Andre Amills, Fica stands for the federal insurance contributions act and requires employers to withhold three separate taxes from an employee’s gross earnings:

What Is FICA Tax How It Works And Why You Pay Poprouser, According to the intermediate projection issued in a may 2025 report, the social security taxable wage next year will be $174,900.

How To Calculate Fica Tax 2025 Megan Madalena, That’d be a $6,300 increase from the.

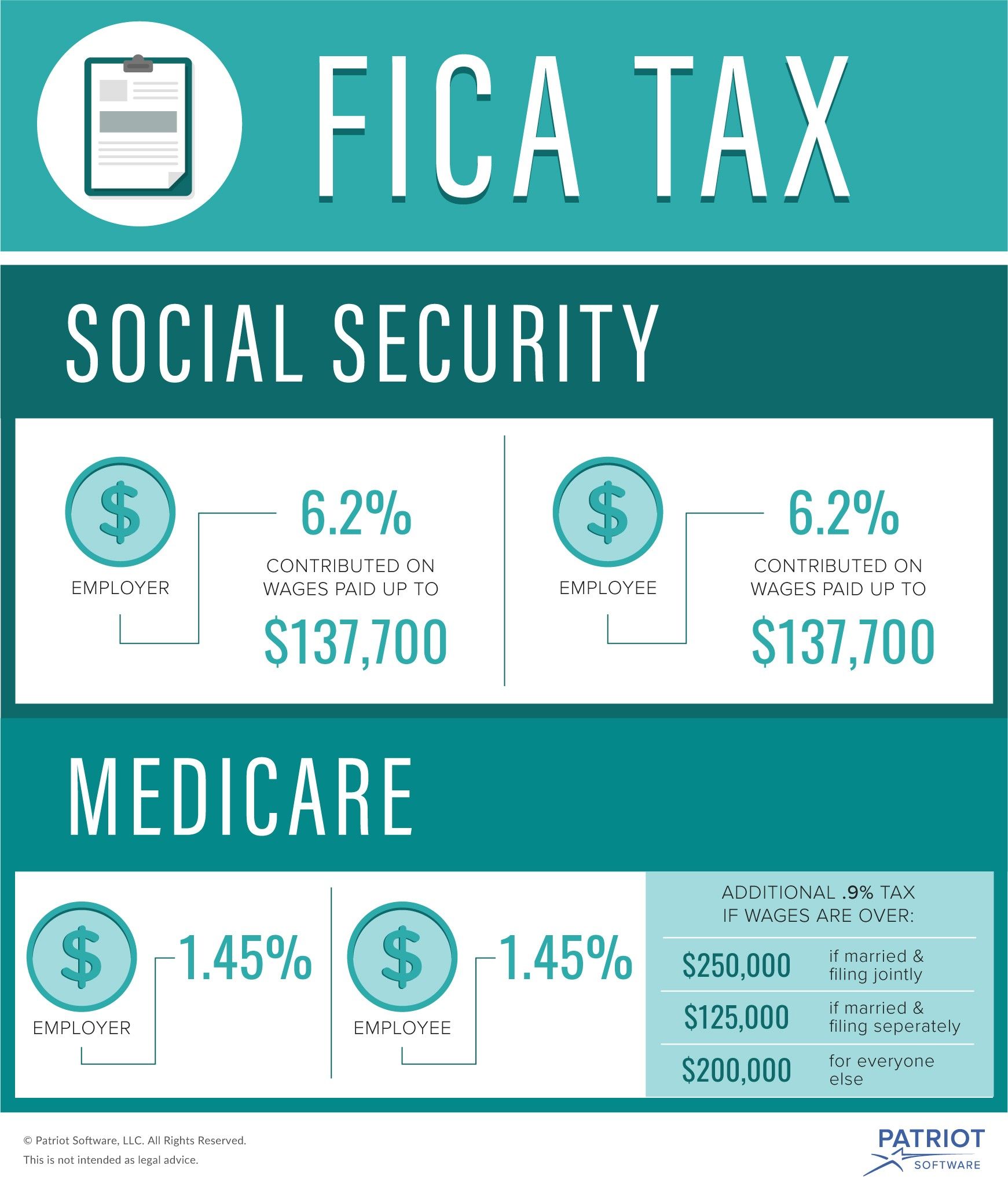

Tax rates are set by law (see sections 1401, 3101, and 3111 of the internal revenue code) and apply to earnings up to a maximum amount for oasdi. The social security tax rates for both employees and employers will remain unchanged at 6.2%, with the maximum tax for each rising from $10,453.20 in 2025 to.

Understanding FICA Tax What You Need to Know Cowdery Tax, For 2025, the ssa has set the cola at 2.5%.

/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

What Is FICA tax, and How Much Is It? Contributions, Due Dates, & More, Employees and employers split the total cost.

How To Calculate Fica Tax 2025 Megan Madalena, The social security tax rates for both employees and employers will remain unchanged at 6.2%, with the maximum tax for each rising from $10,453.20 in 2025 to.

What Is Fica Limit For 2025 Dacia Dorotea, For 2025, the ssa has set the cola at 2.5%.

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Employer Fica And Medicare Rates 2025 Opm Sarah Short, Fica is a 15.3% payroll tax that funds social security and medicare.